In 2013, I kept a close watch on how our family’s savings added up. Daily, weekly, monthly—-I logged each penny that was saved and earned throughout each month. My savings plan continues to negate medical debt by saving at the grocery store and/or other retail locations. I seldom buy anything at a retail value. A few tips that I use are:

In 2013, I kept a close watch on how our family’s savings added up. Daily, weekly, monthly—-I logged each penny that was saved and earned throughout each month. My savings plan continues to negate medical debt by saving at the grocery store and/or other retail locations. I seldom buy anything at a retail value. A few tips that I use are:

- Create a menu plan (know what you need before you need it)

- Eat Clean 90% of the time (replenishing fresh fruits and veggies forces me to go to the grocery store more than once a week, reminds me to buy local fruits & flash freeze, etc.)

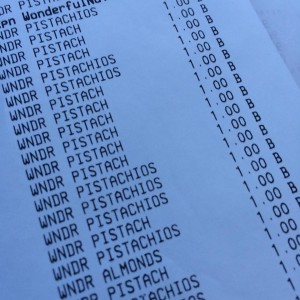

- Use apps (Ibotta, Kroger, Wal-Mart Savingscatcher, Target Cartwheel, Receipt Hog, SavingStar, etc.)

- Use online coupons & bloggers’ notes about deals that fill a need (that’s already on my list or is an item we use daily)

In addition to these few savvy shopping tips, there are many, many more that I use before I shop, while I shop, and after I shop. My personal journey with coupons throughout the years as a stay-at-home mom have taught me more about myself than I ever knew. The savings plan that I sought created a fitter, more energized mom/woman. I found out that I’m a better cook than I gave myself credit for and that I could use my teaching skills to teach others about creating a savings plan.

Coupons were once stowed in a binder but I love life too much to keep up with ALL the coupons ever printed. I opted to house just a few in my purse. They are divided by categories and are ready to use when I’m out shopping. Usually, a star on my grocery list will indicate that I have a coupon for the item(s). If I find a sale, I pull the coupon to use. If I must have the item on this specific shopping trip, I make sure the coupon is already with my cash (for an easier checkout experience).

Coupons were once stowed in a binder but I love life too much to keep up with ALL the coupons ever printed. I opted to house just a few in my purse. They are divided by categories and are ready to use when I’m out shopping. Usually, a star on my grocery list will indicate that I have a coupon for the item(s). If I find a sale, I pull the coupon to use. If I must have the item on this specific shopping trip, I make sure the coupon is already with my cash (for an easier checkout experience).

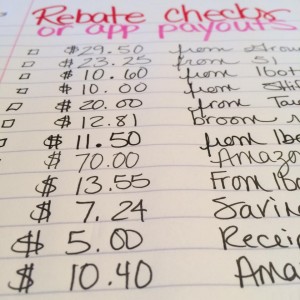

Other coupons and rebates are stowed on my smartphone. I’ve created a savings folder that houses all my money saving apps. I couldn’t live without them (unless grocery prices dropped dramatically)! And since that’s probably not going to transpire, I’m encouraged to use coupons, and apps daily as I shop. Is the time I’ve allotted to my savings plan worth it?

In September 2013, I saved our family $618.45 (includes a little bring home cash from blogging/teaching). This past month, September 2015, I shaved off $783.24 (coupons at local grocery/pharmacy retailers and app money). If I add in the amount of freelance money that I made teaching, blogging, etc., my figure would be upwards of $1,000 for the month. The total actually surprised even me this year. However, I set out this month to make sure I worked diligently in negating debt with the extra cash that I didn’t spend in the grocery store, leave on my receipts, drop in needless retail shops, etc.

I encourage you to look at your monthly earnings, your bills, and your options in turning your extra time into savings. It’s well worth your time if you want to reduce medical debt and/or credit card debt (opt not to shop with them for an entire month or more….), increase savings, etc. In addition to the savings figures I shared with you, I also have STUFF. I’ve been busy giving away freebies that I obtained (although is anything really free). I have drawers full to fill OCC boxes with next month. My stockpiles are full for October and there’s still many frozen staples in my freezer to float us into the holidays (…and we’ve already vowed not to overspend for gifts/meals then too (remember to begin with the end in mind—you don’t want to start a new year broke!?!).

I encourage you to look at your monthly earnings, your bills, and your options in turning your extra time into savings. It’s well worth your time if you want to reduce medical debt and/or credit card debt (opt not to shop with them for an entire month or more….), increase savings, etc. In addition to the savings figures I shared with you, I also have STUFF. I’ve been busy giving away freebies that I obtained (although is anything really free). I have drawers full to fill OCC boxes with next month. My stockpiles are full for October and there’s still many frozen staples in my freezer to float us into the holidays (…and we’ve already vowed not to overspend for gifts/meals then too (remember to begin with the end in mind—you don’t want to start a new year broke!?!).

Where are you in your savings plan this season? It’s a great time to FALL into a plan that fits your family’s needs.

Latest posts by Litsa @How to Have it All (see all)

- Mushrooms: Portobello, Morels, & More - April 25, 2016

- Giving Back: Get Involved - December 2, 2015

- The Autumn Advantage - December 1, 2015